Owner of company I worked for, bought a new 6 figure car for his wife. Titled, registered, and insured through company. When rates were restructured for charging of company equipment to customers, he included this car. When tax time rolled around, he de-appreciated this car. In essence he ended up paying nothing for this car, probably made money at both taxpayers and customers expense.

Said car was never used for business, only the wife drove it and she had nothing to do with the company. Owner bragged about.

So you want to allow frivolous tax deductions for business, but myself who HAS to buy specific safety gear for the work that I do I can not deduct anything because when they rewrote the standard deduction they also rewrote the rules for deductions to reduce the amount they are worth.

And yes, under the OLD rules, I would still have more in itemized deductions than the current standard deductions.

Without said employees, both large and small companies would not be able to exist, and yet business owners see no problem putting the onus of paying a fair tax bill on these same people.

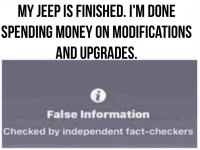

Yes, businesses should also pay a flat tax on NET profit for the year, businesses should lose FRIVOLOUS write offs. I don't care if YOU have never done it, it is done all day every day by a majority of businesses.