You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Banks/Money Managment

- Thread starter longarmwj

- Start date

OverlanderJK

Resident Smartass

Where are the large companies/banks that can come buy my house?This video is 26 minutes, but I will say damn worth watching. Especially if you're a real estate investor, or thinking of buying/selling soon.

WJCO

Meme King

Wells Fargo tells customers it’s shuttering all personal lines of credit

Wells Fargo CEO Charles Scharf has been forced to make hard decisions during the pandemic, offloading assets and deposits and stepping back from some products.

HighwayTrout

Hooked

Wells Fargo tells customers it’s shuttering all personal lines of credit

Wells Fargo CEO Charles Scharf has been forced to make hard decisions during the pandemic, offloading assets and deposits and stepping back from some products.www.cnbc.com

Good. One less junk mail offer.

WJCO

Meme King

Freddie Mac launches new home renovation mortgage, here's how to get one | Fox Business

Freddie Mac introduced its new home renovation product that will combine with mortgage purchases or refinances. Here's how to get one and other home improvement loan options.

OverlanderJK

Resident Smartass

Nothing like a 40+ year mortgage. MericaFreddie Mac launches new home renovation mortgage, here's how to get one | Fox Business

Freddie Mac introduced its new home renovation product that will combine with mortgage purchases or refinances. Here's how to get one and other home improvement loan options.www.foxbusiness.com

HighwayTrout

Hooked

Freddie Mac launches new home renovation mortgage, here's how to get one | Fox Business

Freddie Mac introduced its new home renovation product that will combine with mortgage purchases or refinances. Here's how to get one and other home improvement loan options.www.foxbusiness.com

Elroy231

Active Member

Nice to watch a real estate agent tell the truth. So often they can become used car salesmen.

I've been payin attention to the evergande situation. I won't pretend that I know all about it. I know enough to be concerned by how it effects the global market. The shit show did not end in 2020, unfortunately.

WJCO

Meme King

Think Everything’s Expensive Now? Get Ready for What’s Next

Consumers around the world are about to get socked with even higher prices on everyday items, companies from food giant Unilever Plc to lubricant maker WD-40 Co. warned this week as they grapple with supply difficulties.

WJCO

Meme King

Walmart has reportedly cut 200 jobs from its Bentonville, Arkansas, headquarters

The Wall Street Journal reported that the Bentonville, Arkansas-based retailer has laid off around 200 corporate workers.

GEICO abruptly closes offices across California

According to the California Department of Insurance, GEICO closed all of its brick and mortar stores and continues to sell insurance policies online

jeeeep

Hooked

commifornia forcing all business out, they will soon be setting up government owned replacements

Walmart has reportedly cut 200 jobs from its Bentonville, Arkansas, headquarters

The Wall Street Journal reported that the Bentonville, Arkansas-based retailer has laid off around 200 corporate workers.www.businessinsider.com

GEICO abruptly closes offices across California

According to the California Department of Insurance, GEICO closed all of its brick and mortar stores and continues to sell insurance policies onlinewww.abc10.com

WJCO

Meme King

Landlords Face a $1.5 Trillion Bill for Interest Only Commercial Mortgages

Commercial Real Estate BustA trend to walking away from commercial mortgages is just beginning. The Wall Street Journal reports Interest-Only Loans Helped Commercial Property Boom. Now They’re Comi…

jeeeep

Hooked

they keep gambling with the same crystal ball hoping for a different outcome, "Interest rates would stay low forever", "Property values, already clearly in a bubble, would keep rising forever"

Landlords Face a $1.5 Trillion Bill for Interest Only Commercial Mortgages

Commercial Real Estate BustA trend to walking away from commercial mortgages is just beginning. The Wall Street Journal reports Interest-Only Loans Helped Commercial Property Boom. Now They’re Comi…mishtalk.com

Before the subprime mortgage and housing crash, financial company told us we could qualify for far more than I felt comfortable with and used similar bullshit lines "it's interest only, your payment will stay low and when the mortgage comes due your income will have increased substantially, rates will stay steady for years, your home value will continue to increase well above what you're borrowing, your property taxes will drop as soon as they pass the current legislation" then the mortgage crisis hit and nothing went down except home values.

Several friends who bought into the bullshit had interest only loans, they walked away from their homes.

Every time I heard "your ...will..." I asked them to put it in the contract and how they would guarantee the outcome if their crystal ball failed to produce, they hated that. lol

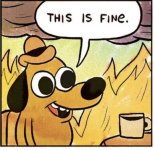

WJCO

Meme King

I remember back around 2007. I just had this weird feeling like Neo from the matrix. Something wasn't right and I just couldn't put my finger on it. I looked around at culture and everything and everyone was living this great perfect dream but there was no realistic substance to it. I remember asking myself 'How is this working?' Shortly after was the crash. And the system (matrix) didn't fix shit. Here we are 15 years later. And it's worse. Nothing fixed. We are living in the making of history right now. It takes a mid six figure income right now for a basic family to afford an average home in most of America. And this is just the residential part.they keep gambling with the same crystal ball hoping for a different outcome, "Interest rates would stay low forever", "Property values, already clearly in a bubble, would keep rising forever"

Before the subprime mortgage and housing crash, financial company told us we could qualify for far more than I felt comfortable with and used similar bullshit lines "it's interest only, your payment will stay low and when the mortgage comes due your income will have increased substantially, rates will stay steady for years, your home value will continue to increase well above what you're borrowing, your property taxes will drop as soon as they pass the current legislation" then the mortgage crisis hit and nothing went down except home values.

Several friends who bought into the bullshit had interest only loans, they walked away from their homes.

Every time I heard "your ...will..." I asked them to put it in the contract and how they would guarantee the outcome if their crystal ball failed to produce, they hated that. lol